If you're going to sell your Hermès, is it “now” or “a little later”? Depending on when you sell, the amount you receive can differ by hundreds of thousands of yen.

In reality, Hermès adjusts its prices almost every year, and the market trend is upward.

For example, the Kelly 25 has increased in price: Togo (inside stitching) went from 1,452,000 yen to 1,859,000 yen (2023 → 2025), and Epsom (outside stitching) rose from 1,562,000 yen to 1,947,000 yen. The Mini Evelyne has also risen from around the 280,000 yen range to the 350,000 yen range. (*Prices are as of the time of article update.)

The key to avoiding loss and selling at a high price is understanding and timing your sale during “market fluctuation periods,” such as official price revisions, currency exchange fluctuations, and periods of overseas demand.

In this article, based on the latest 2025 market data, we thoroughly explain:

If you want to smartly manage your Hermès items as assets, be sure to use this as a reference.

*The retail and resale price information introduced in this article is based on the information at the time of publication. The market may fluctuate. For the latest information, please check with official or specialty stores. You can also inquire about the latest market via XIAOMA’s official LINE — feel free to use it.

Hermès is not “just a fashion item” — it is a special item with asset value.

Therefore, getting the timing wrong can lead to differences of hundreds of thousands of yen.

Here, let’s organize the characteristics of the Hermès market and the main factors that influence market trends, to understand why profit/loss changes based on timing.

Hermès has high global demand, and prices fluctuate depending on market conditions.

The following periods especially tend to see price increases:

Retail price increases = rise in secondhand market prices.

Recently, major price hikes occurred in 2024–2025 for Kelly, Birkin, etc., leading to market price increases across both new and used items.

However, resale market prices often reflect these changes slowly, over weeks or months, so aiming for “right after” revisions carries risk.

During a weak yen, overseas buyers actively purchase in Japan.

Lunar New Year (late Jan–mid-Feb) and summer bonus season in the West are peak overseas demand times, pushing up prices.

High gift demand and year-end bonuses activate the luxury market, including Hermès.

This time sees fast sales and strong prices — ideal for those who want quick cash.

For models like Birkin or Kelly, prices can surge after releases of trendy or limited editions due to short-term demand spikes.

Note: this depends heavily on the model and exclusivity, not overall market trends.

You May Also Like:

Representative Hermès Price Guide (2025 Estimates)

※These are indicative market prices as of 2025. Prices may vary depending on the conditions of color, hardware, stamp, accessories, etc.

Taking these market trends into account, it becomes easier to concretely envision decisions such as whether to sell before a price revision or wait for it, or whether to aim for seasonal demand.

Also worth reading:

Just as important as market trends are the owner’s circumstances and the condition of the bag.

Here, we’ll organize the “cases where you should wait” and the “cases where you should sell immediately.”

In conclusion, it’s effective to wait while being aware of price revisions or overseas demand periods, but considering exchange rate risks and bag condition, choosing to sell immediately is also a fully rational decision.

Whichever you choose, understanding why you’re selling at that timing is the key to avoiding regrets.

And when in doubt, it’s safest to consult with an expert to judge whether you “should sell now or wait.”

At XIAOMA, we also offer honest suggestions like “it’s better not to sell right now,” based on the latest market trends and price revision impacts.

First, feel free to check the value of your Hermès on LINE.

▶︎ Try our free LINE appraisal

To sell Hermès at a high price, not only when you sell, but also how you sell is important.

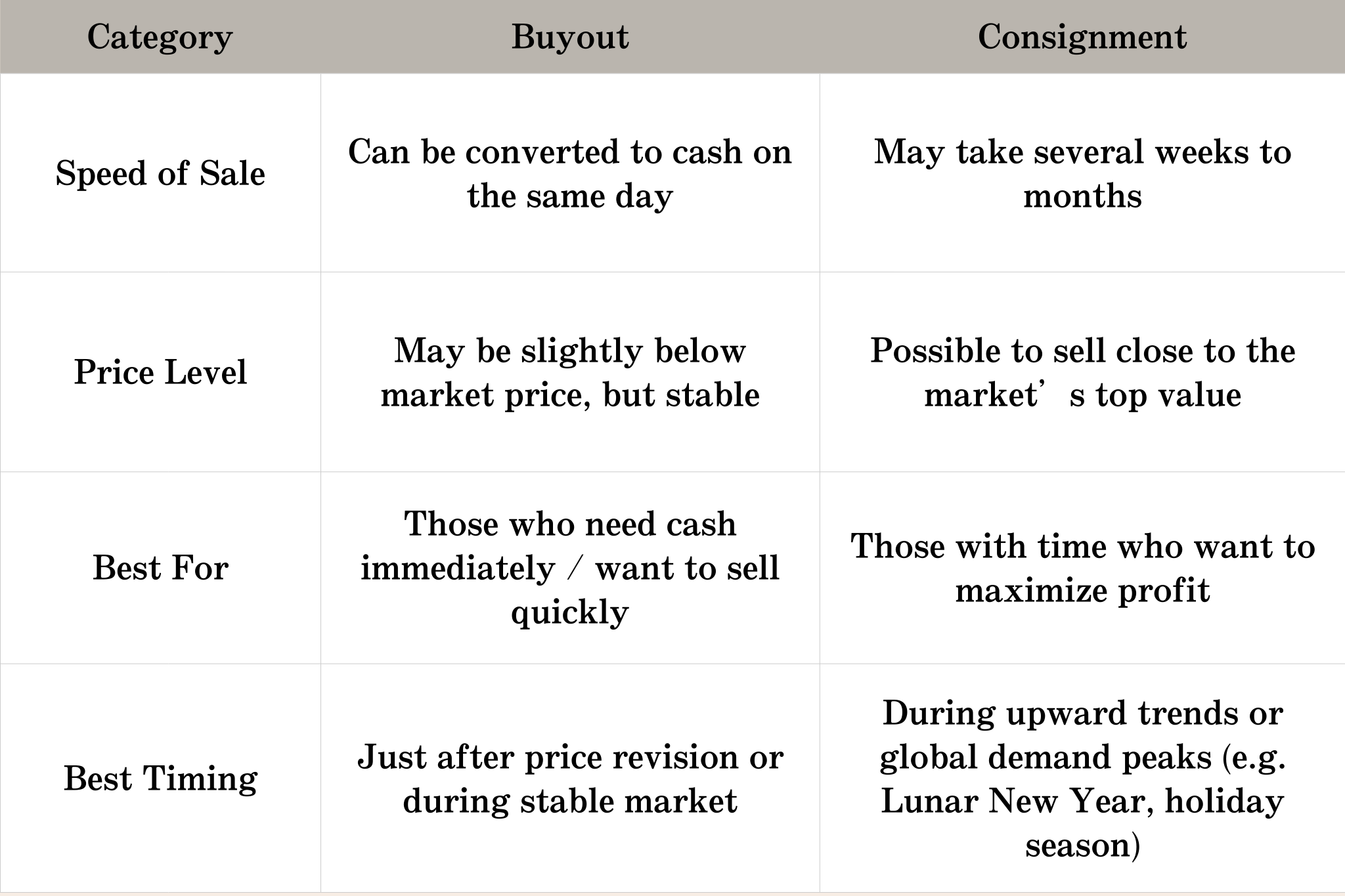

The typical methods are buyback and consignment sales.

Since the best timing differs for each, it’s important to choose according to your purpose.

Consignment: Strong in an Upward Market

※The above are general guidelines. The optimal selling method can vary depending on the model, material, or color.

At XIAOMA, we provide the best advice based on characteristics of each model including Birkin and Kelly, and global demand trends.

If you're unsure whether to "sell now" or "wait a little longer," please feel free to consult us.

▶︎ Try XIAOMA's Free LINE Appraisal

A: If the market is trending upward, waiting might bring a better return.

However, due to factors like currency fluctuations, the market may decline instead—so "now" can also be advantageous.

Also, even after a price revision, resale value might not immediately increase, so it’s not guaranteed you’ll sell higher “right after the revision.”

If you're unsure, we recommend getting quotes from multiple stores and observing market trends.

▶︎ Check the current market with XIAOMA’s LINE appraisal

A:Yes. Even for first-time sellers, timing has a major impact.

Especially after a price revision or during overseas demand periods, you’re more likely to receive higher appraisals.

That’s why aiming for a strong market period is particularly recommended for first-time sales.

A:Yes.

Models like Picotin and Evelyne, often used for daily wear, also see price fluctuations based on retail price revisions and demand periods.

Especially for popular colors or rare materials, prices can change in the short term—so timing your sale is critical.

A: Depending on the case, the price difference could be in the tens of thousands of yen.

For example, the Kelly 25 (Togo leather, inward stitching) saw a retail price increase of about ¥400,000 between 2023 and 2025, and resale prices followed suit.

For a brand-new Birkin 25 in Togo, there were cases where prices differed by ¥300,000 to ¥500,000 between peak and off-peak demand.

For rare models like Porosus or Himalaya, auction sale prices have fluctuated by more than ¥1,000,000.

Also Recommended Reading:

Hermès is a brand whose buyout prices are heavily influenced by price revisions and demand trends.

OAs introduced above:

Knowing these will help you sell smarter and avoid losses.

What matters most is combining market knowledge with an understanding of your item's current value to make the right decision.

As your first step, try XIAOMA’s free LINE appraisal service.

Our experienced appraisers will give you a realistic market value based on model, stamp, and color.

Turn your Hermès into an asset—sell at the best possible time.

XIAOMA is here to support your next move.

All price and buyout data mentioned in this article are as of the article update date. Market prices are subject to change.

For the latest info, please check with official boutiques or specialty stores. You can also consult the latest prices via XIAOMA’s official LINE account.

Also Recommended: