Hermès’ iconic jewelry piece, the “Chaîne d’Ancre,” has continued to exude timeless charm since its debut in 1938. Its unique design, featuring interconnected chains, stands out not only as a fashion statement but also for its high asset value.

Especially models made from rare materials like silver and K18 gold, as well as vintage pieces from the Martin Margiela era, are hard to find at official stores and tend to fetch high prices in the secondhand market.

Moreover, annual price adjustments have steadily increased its price, making it a popular choice among enthusiasts who prioritize asset value, regarding it as a “once-in-a-lifetime investment jewelry.”

In this article, we’ll thoroughly explain why the Chaîne d’Ancre’s asset value is highly regarded, the price trends from 2021 to 2025, the latest resale market prices, and the benefits and cautions of owning it as an asset.

There are several reasons why the Chaîne d’Ancre is considered an asset-worthy “jewelry for life.”

Here, we’ll explain the background appeal of its design, rarity, and evaluation in the resale market.

Born in 1938, the Chaîne d’Ancre is characterized by its unique form inspired by anchor chains. Its design is simple yet powerful, resisting trends and loved across generations.

It is this “timelessness” that makes it easier to maintain long-term value as an asset.

Hermès jewelry is handmade by skilled artisans, preventing mass production.

Therefore, the annual production volume is limited, and even restocking of the same model is often uncertain.

This “rarity” is one of the main factors driving the Chaîne d’Ancre’s asset value.

The Chaîne d’Ancre enjoys consistently high demand in the secondhand market, where well-maintained pieces sometimes trade at prices close to or even above retail.

Gold models, larger bracelet sizes, and vintage pieces from the “Margiela period” are especially rare and maintain stable resale value.

▶︎ For those interested in different models and sizes, please also check the “Complete Guide to Chaîne d’Ancre.”

What is the Margiela period?

This refers to the era from 1997 to 2003 when designer Martin Margiela served as Hermès’ Artistic Director. Jewelry and accessories, including the Chaîne d’Ancre, gained minimalistic and modern elements during this time, earning high praise from collectors.

Due to limited production, these vintage pieces often fetch premium prices in the current vintage market.

The Chaîne d’Ancre’s high asset value stems from its rarity, materials, and model-specific features.

Here we summarize the key factors influencing its value.

Silver is the most common material, but K18 gold pieces are overwhelmingly rare and attract attention as jewelry investments.

Rising gold prices also support their value, resulting in stable and high evaluations in the resale market.

Popular sizes like MM and GM tend to attract more demand and command higher prices in the secondhand market due to limited circulation.

Vintage models, having aged over time, attract strong collector demand and are less likely to drop in value.

The Margiela period pieces are especially notable.

Because of their design uniqueness and limited production, they hold high rarity and often command premium prices at auctions and resale.

In the secondhand market, factors like minimal scratches or discoloration and the presence of original boxes, pouches, and certificates greatly impact appraisal value.

Hermès as a brand places high importance on accessories, so everyday maintenance and careful storage are essential to preserve asset value.

▶︎ For tips on selling your Chaîne d’Ancre at a higher price, please also see “Tips to Boost Appraisal Value.”

The retail price of the Chaîne d’Ancre has been rising year by year, reinforcing its high asset value.

Especially since 2023, price hikes have been significant, sharply increasing its investment appeal in a short time.

Note: Prices are as of article update and may change.

From 2023 to 2024, MM size rose by about 24%, and GM size by about 28%, marking tens of percent increases in just one year—strong proof of its asset strength.

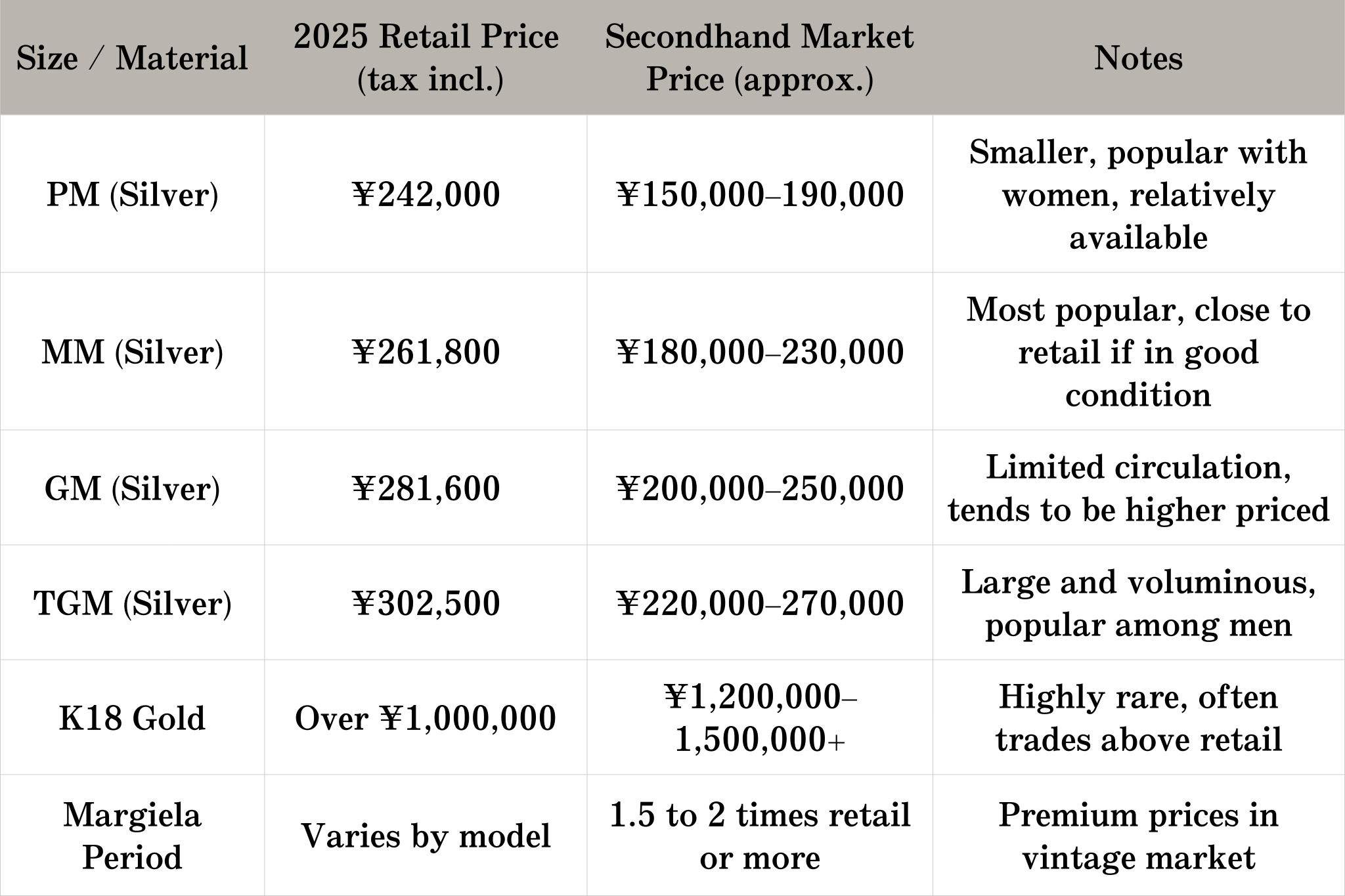

As of February 2025, the retail prices for Chaîne d’Ancre are:

※Note: K18 gold models vary widely and can exceed ¥1,000,000. For those prioritizing asset value, gold models’ stability is a key point.

▶︎ For the latest prices and buyback values of all Hermès products, please see the “Hermès Buyback Price List.”

Since it’s difficult to acquire at official stores, the Chaîne d’Ancre enjoys strong demand in the resale market.

Following price hikes since 2023, resale prices have also trended upward, clearly reflecting its high asset value.

※Note: Prices are reference as of article update and may fluctuate.

Silver is the most widely circulated material.

Popular MM and GM sizes often trade near retail prices if well maintained.

Price hikes since 2024 have also stabilized the secondhand market at high values.

Gold versions are less common and sometimes sell above retail in the resale market.

Rising gold prices also support this trend, increasing demand among investors.

The Margiela period pieces, from 1997 to 2003, remain particularly sought-after by collectors.

These models frequently sell for 1.5 to 2 times the retail price or more in vintage markets, symbolizing asset value.

Though fashion jewelry, Chaîne d’Ancre also carries asset value.

If you consider long-term ownership, it’s important to understand both benefits and risks.

Here, we’ve compiled frequently asked questions about the asset value of the Chaîne d’Ancre and the best timing for selling it in a convenient Q&A format.

A: As is common with Hermès products in general, price revisions happen almost every year, and the asset value tends to increase over the long term. Especially models made with gold or from the Margiela period have strong collector demand, so their potential for value growth is considered significant.

A: It’s hard to say definitively, but following the significant price increases since 2023, the market has been stable and prices remain high. If you need to convert to cash soon, now could be a good opportunity, but holding onto gold models or rare editions long-term could lead to further price increases.

A: Generally, K18 gold pieces and vintage models from the Margiela period are considered to have the highest asset value. Larger sizes like MM and GM are highly sought after, so even silver models often sell close to their retail price.

A: Prices vary depending on material, size, and condition, but silver MM and GM models typically appraise around ¥190,000 to ¥250,000. Gold pieces and Margiela vintage models often fetch even higher prices, sometimes exceeding retail.

Chaîne d’Ancre is positioned as a jewelry piece with very high asset value thanks to its timeless design, rarity, and the trusted Hermès brand. As seen in price trends since 2021, prices have steadily increased each year, and stable high prices are maintained in the resale market.

While there are clear benefits to owning it as an asset, such as stability and collectibility, buyers and sellers should be aware of risks like counterfeits and the need for proper maintenance. Therefore, choosing a reliable specialist store when buying or selling is essential.

At Hermès specialty store XIAOMA, expert appraisers with 10 to 30 years of experience carefully inspect every Chaîne d’Ancre piece under strict criteria, ensuring peace of mind for customers.

Moreover, XIAOMA has a buyer network across over 50 countries worldwide, guaranteeing fair and up-to-date appraisals when you consider selling. They support you in protecting your asset’s value while helping you make the best choice.